ACTIVITY BASED COTING ALLOWS THE COMPANIES TO SET COMPETITIVE PRICING

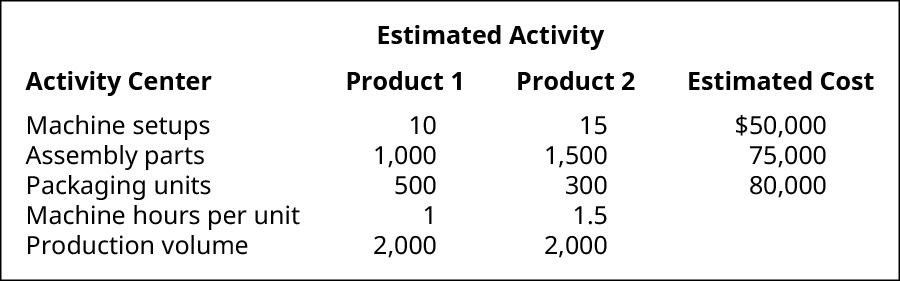

The activity-based costing system provides a set of non-financial performance measurements including time and quality helps in the preparation of budgets and effectively influences the pricing decisions through the cost of diversity calculated in a more precise manner because there are some costs that might not be related to the size but are highly complex. Pricing products is essential for an organization and it is an Activity Based Costing method that helps in making accurate assumptions about the various offerings.

Salesforce Retail Has Transformed Retail Shopping Experiences For Billions Of Customers Check Out This Ultimate Salesfo Salesforce Retail Salesforce Developer

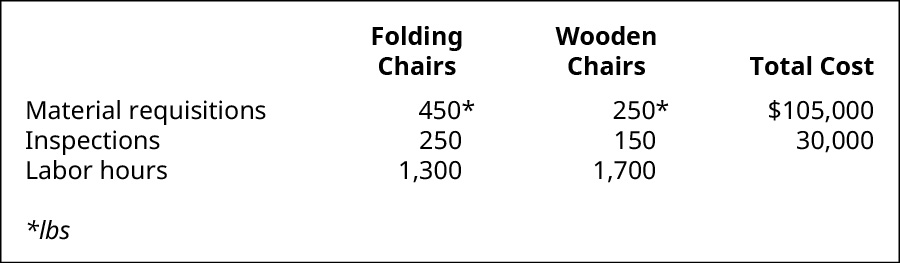

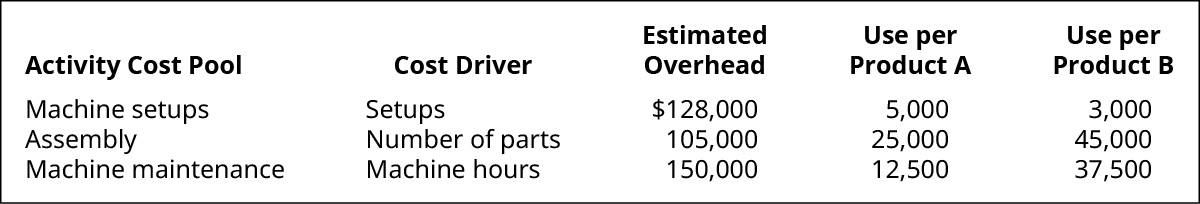

Activity-based costing assigns costs to those factors and activities that have a direct cause and effect relationship with a particular overhead cost.

. Find the True Cost of Products. At its core activity-based costing ABC is about cost management. The first step in activity-based costing involves identifying activities and classifying them according to the cost hierarchy.

B Activity-based costing is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products. Learn now what ABC. The Advantages of Activity Based Costing.

Unit level activities are activities that. Cost hierarchy is a framework that classifies activities based the ease at which they are traceable to a product. Activity-based costing starts with the identification of activities and then the production of goods while traditional costing starts with the identification of costs and then the production of goods.

Determine the costs of each strategic action a company initiates. This is reducing and controlling costs while still creating a quality product. Activity Based Costing.

Strategic ABM uses activity-based costing to analyze the profitability of an activity which may even be the unrolling of a new product or acquiring a new customer. Activity Based Costing is an accounting method of costing that is used to find the total cost of activities that are required to make a product. Of activities to arrive at a profit.

Activity-based costing is an approach that allocates fixed overhead and administrative costs to activities which are cost-incurring events. Using activity-based costing forces the business to spend time defining the activities that can increase cost which leads to a better understanding of expenses and more accurate product pricing. Activity-based costing is used to evaluate a companys cost-competitiveness and Multiple Choice analyze the costs of each primary activity.

Cost driver rate which is calculated by total cost divided by total no. Cost drivers may be volumebased activitybased or based on any number of other operational characteristics. Also with a small business the complexity of the process decreases drastically since often there are only a few cost-increasing activities that need consideration.

Activity based costing is the process of assigning indirect costs in the form of salaries and utilities to different products and services. Activity based costing also known as ABC costing refers to the allocation of cost charges and expenses to different heads or activities or divisions according to their actual use or on account of some basis for allocation ie. ABC allows managers to identify how various cost objects are using resources differently and to.

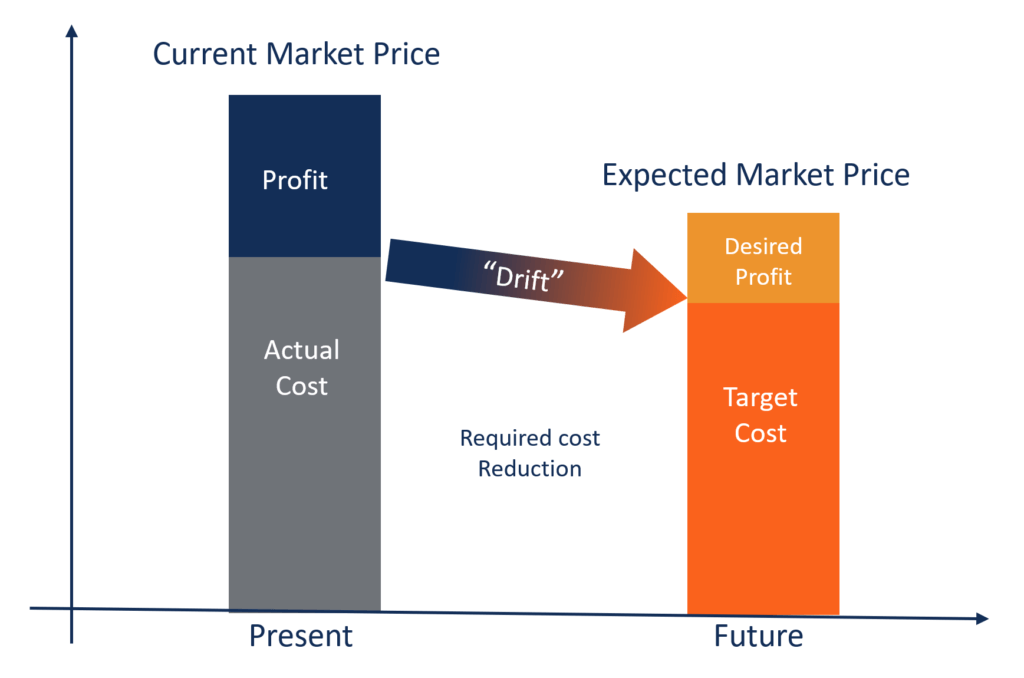

Statement II says that cost drivers may be volume based or activity based. Because there is more accuracy in the costing using ABC can help provide better pricing and sales strategies. Cost reduction generally requires a change in activities.

Used in large-scale manufacturing companies activity-based costing can also be a. The levels are a unit level b batch level c product level and d facility level. D Chances of product-cost cross-subsidization are higher in activity-based costing.

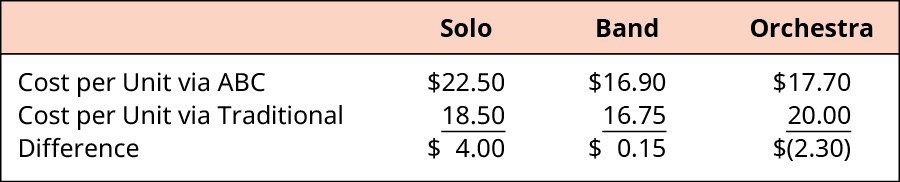

As a resultl many turn instead to Activity Based Costing for costing accuracy. Statement II is correct. It also improves performance management policies and allows for those involved to make better decisions because their information is more accurate.

While activity-based costing focuses attention on activities in allocating overhead costs to products activity-based management focuses on managing activities to reduce costs. It allows the company to obtain a strategic picture of which products and customers to develop andor pursue in order to boost sales and profitability. Activity-based costing plays an important role in companies strategies and long-range plans to develop a competitive cost advantage.

Statement III says that cost drivers are normally the largest cost in the manufacturing process. Activity-based costing is a cost accounting method designed to help businesses accurately price their products. So that is two out of three.

It provides a more accurate cost per unit. Activity based costing for companies is all about devising the appropriate pricing strategy for identifying product costing product line profitability analysis target costing and service pricing strategies. C Activity-based costing classifies some of the indirect costs as direct costs.

Activity Based Costing focuses primarily on activities carried out for the manufacture of products whereas Traditional Costing focuses primarily on cost determination after they have been. However In some settings traditional costing gives notoriously misleading estimates of these costs. Knowing the true cost of individual products and services precisely is crucial for product planning pricing and strategy.

Determine whether the value chains of rival companies are similar or different.

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

Activity Cost Pools Definition Examples Video Lesson Transcript Study Com

Activity Based Costing A Tool For Decision Making Fibre2fashion

Activity Based Costing A Tool For Decision Making Fibre2fashion

Activity Based Costing Uses Advantages And Disadvantages Marketing91

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

Ex Post And Ex Ante Accounting And Finance Investing Economics Lessons

Activity Based Costing Uses Advantages And Disadvantages Marketing91

Target Costing Key Features Advantages And Examples

Recruitment Marketing Analytics Recruitment Marketing Marketing Analytics Infographic Marketing

Activity Based Costing Uses Advantages And Disadvantages Marketing91

Get Our Sample Of Information Technology Strategic Plan Template 3 Year For Free Online Business Plan Template Strategic Planning How To Plan

Activity Based Costing Uses Advantages And Disadvantages Marketing91

Strategy Map Business Strategy Business Corporate Strategy

Single Point Registration Scheme Now Completely Online Schemes Small Enterprises Enterprise

Activity Based Costing A Tool For Decision Making Fibre2fashion

Porter S Five Forces Of Competitive Position Http Www Businessballs Com Portersfiveforcesdiagram Pdf Strategieentwicklung Entwicklung

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

0 Response to "ACTIVITY BASED COTING ALLOWS THE COMPANIES TO SET COMPETITIVE PRICING"

Post a Comment